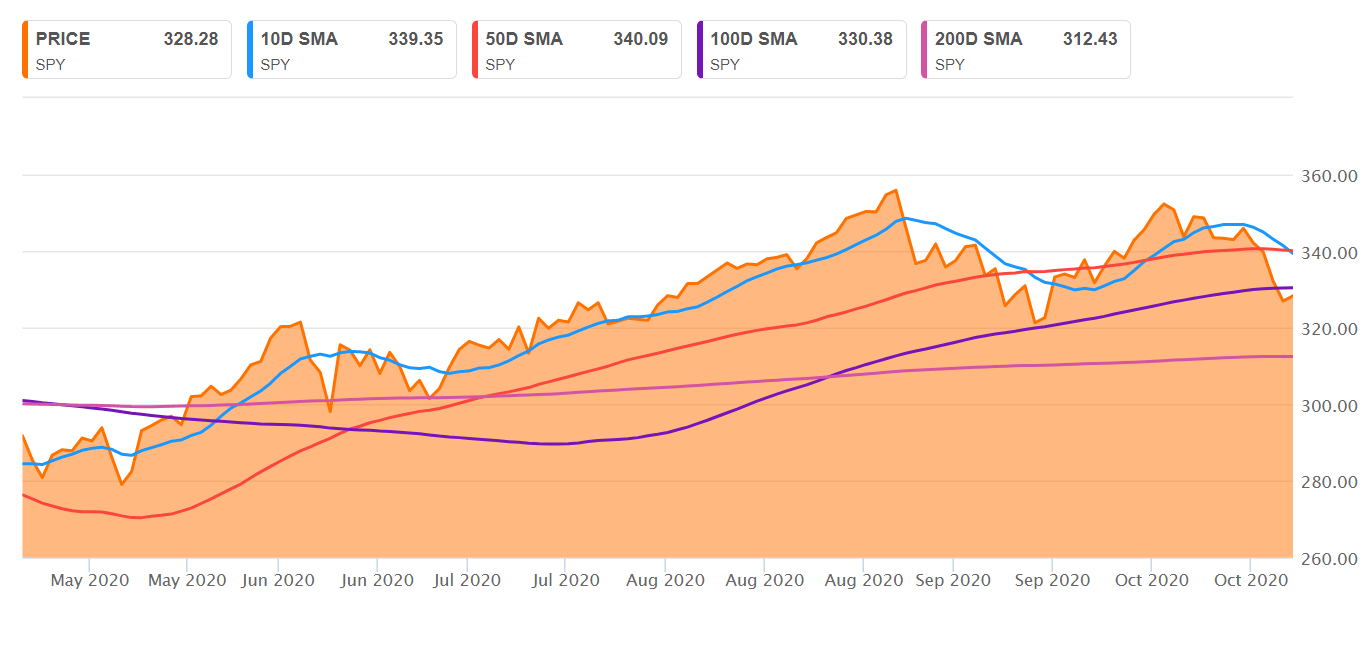

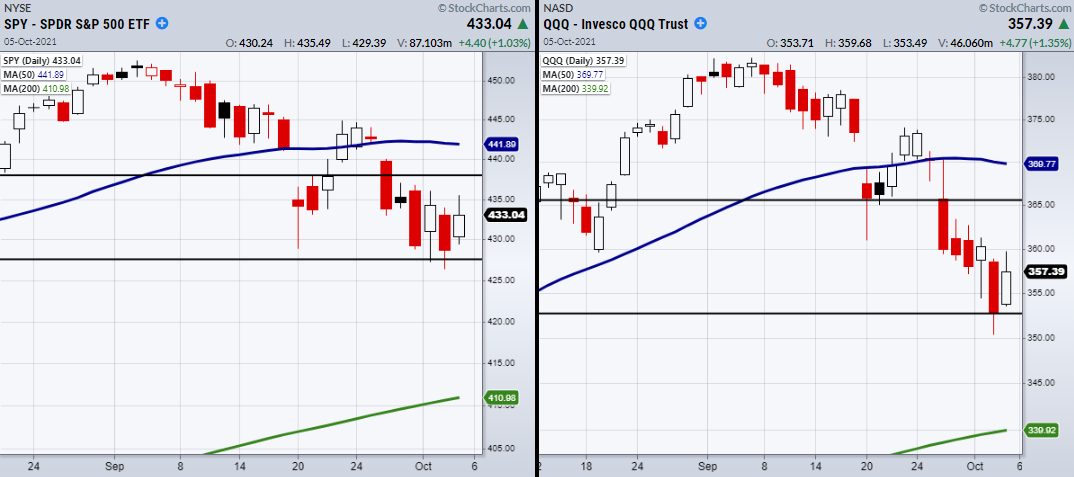

4,444 = 50 Day Moving Average (which is where the S&P hung out the previous 3 sessions) 4,342 = 100 Day Moving Average (Tuesday's intraday low of 4,346 flirted with this level) 4,128 = 0 Day Moving Average (not likely to make it down herebut every now and then the market needs a good house cleaning to shake off complacencySPY Historical Data Get free historical data for SPY You'll find the closing price, open, high, low, change and %change of the SPDR S&P 500 ETF for the selected range of dates The data can be A couple of thoughts As The Yuan Turns, and as we hover near the 0day simple moving average in the SDPR S&P 500 ETF Trust (SPY) I rarely care much "why" the market moves I kind of go on this

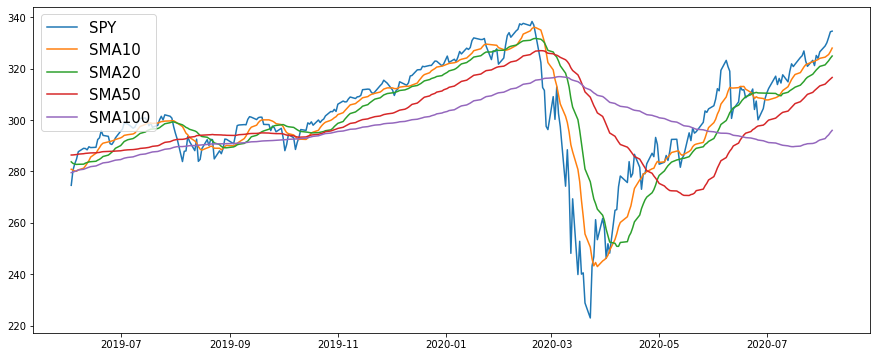

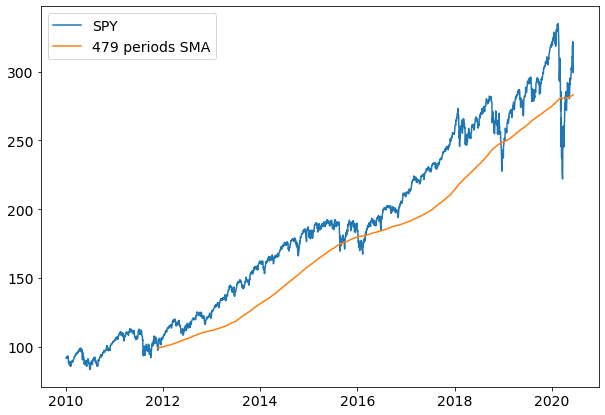

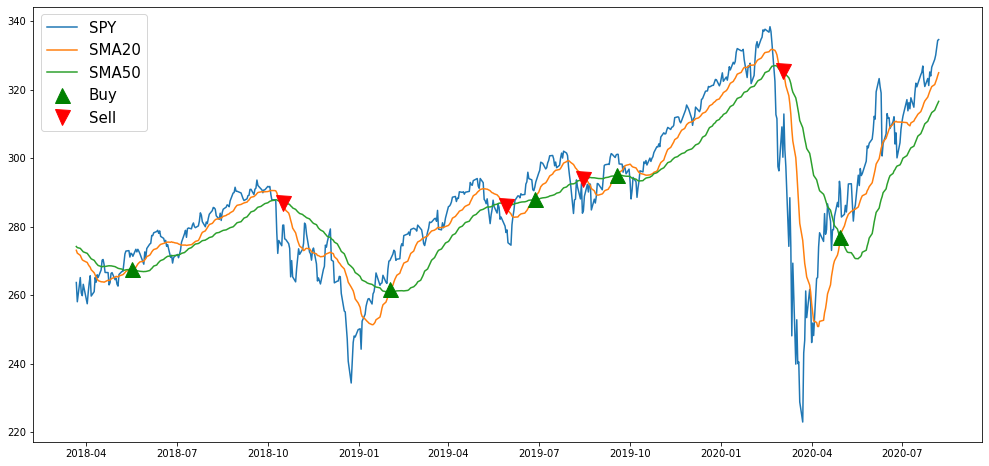

Algorithmic Trading In Python Simple Moving Averages By Aidan Wilson Towards Data Science

Spy 100 day moving average

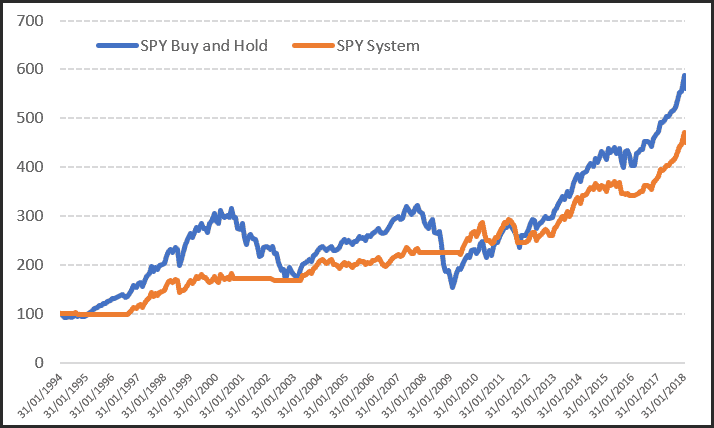

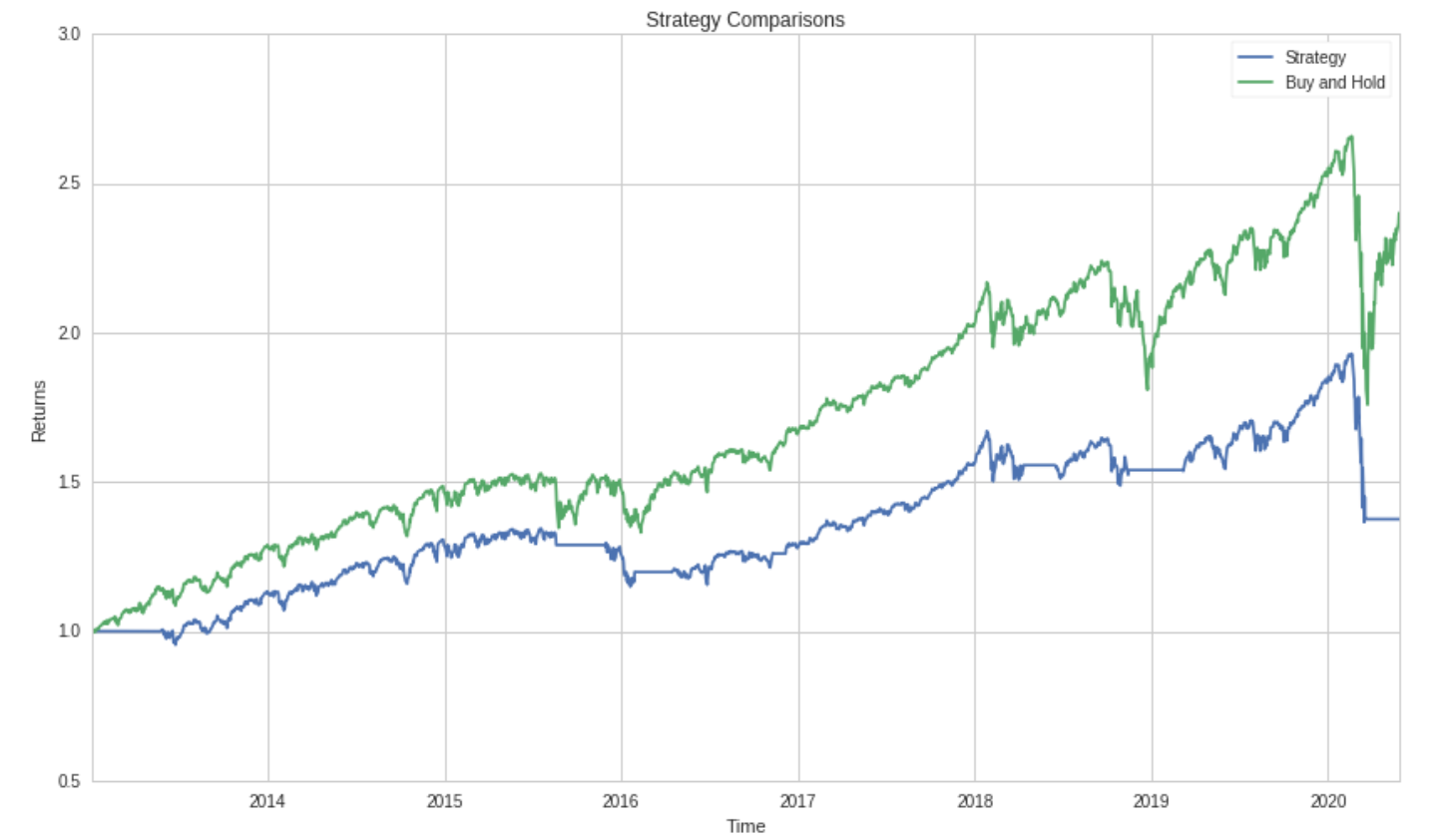

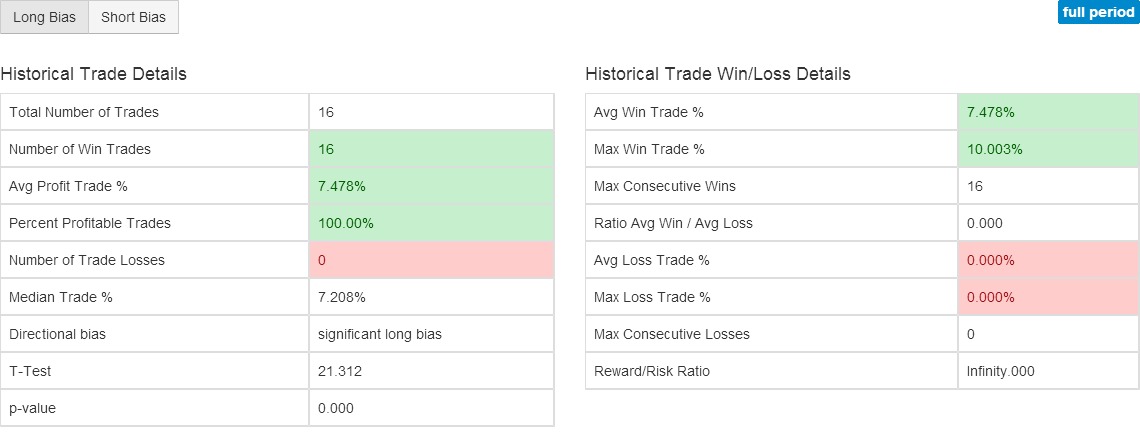

Spy 100 day moving average-Here are the results These results can look deceiving because a simple buyandhold of SPY outperformed the strategyGet the best moving average crossover for swing trading using the 0 day moving average rule This strategy should be used to define the current big picture trend and also give you an idea when to go long or short It is one of the most profitable moving average forex

Using Pmi Data For Tactical Asset Allocation Backtestwizard

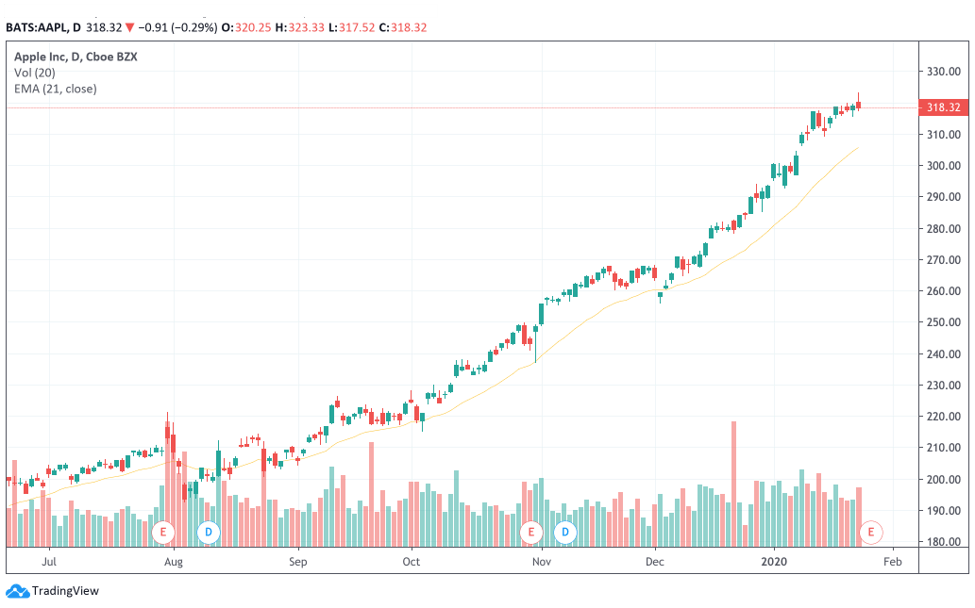

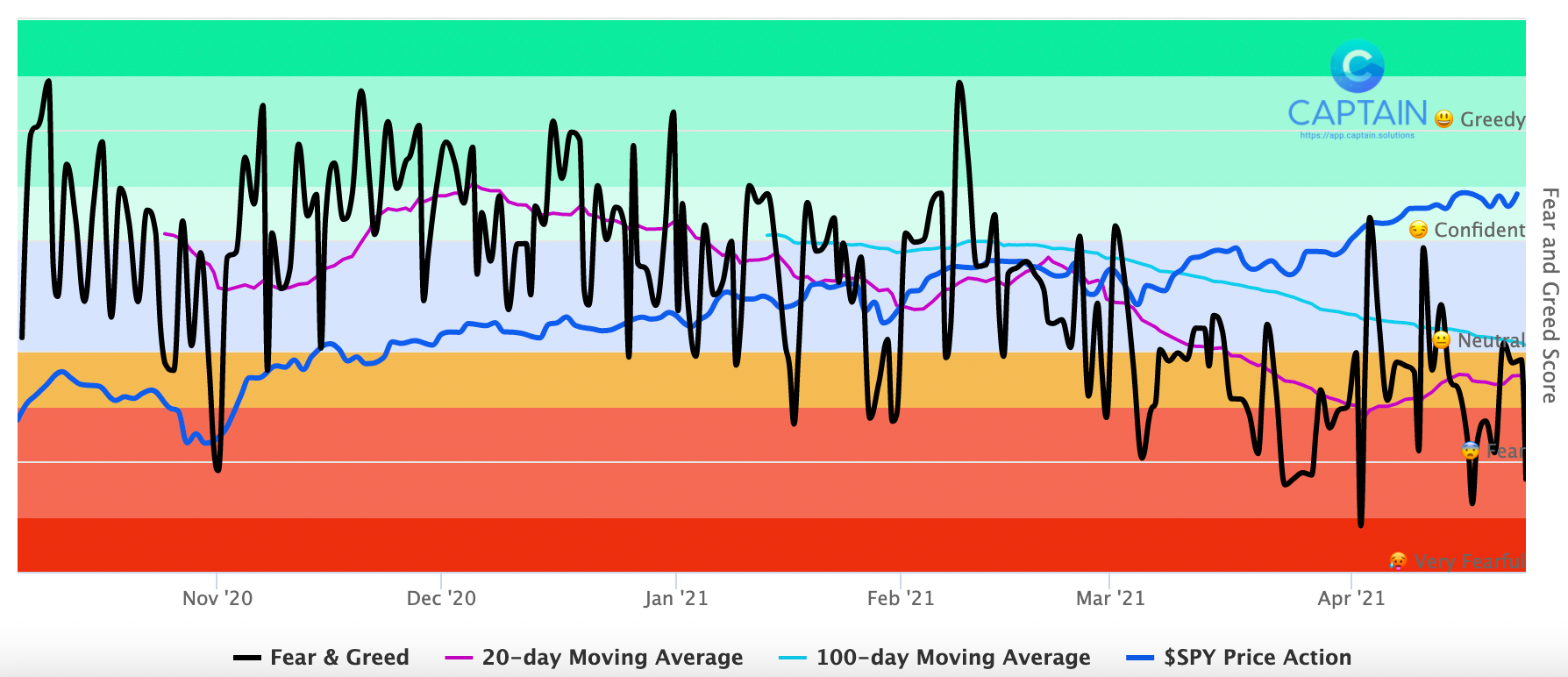

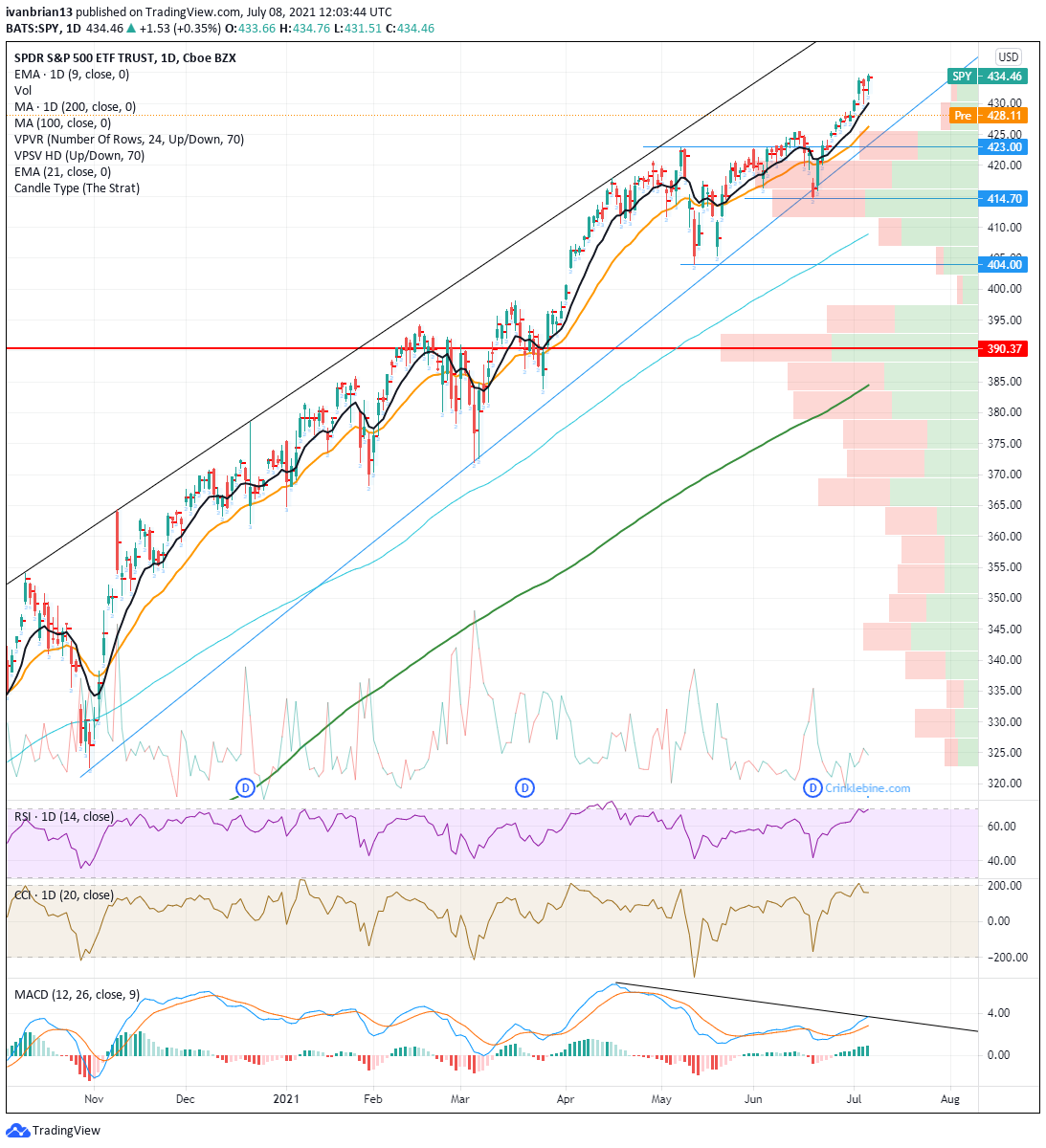

by ColeJustice OptionsMillionaire's SPY Options trading system is based mainly on these indicators 8 EMA* 21 EMA* 100 SMA* 0 SMA* MACD RSI Squeeze Momentum (*provided by this indicator) and follows these rules 1) I never fight the trend If its green, i buy calls If its red, i buy puts I will only buy puts on a green day if there is a overall change in market S&P 100 portfolio test results As you can see from the table, the best moving average for a 5/ day crossover was the exponential moving average (EMA) which gave a compounded annualised return of 36% and a maximum drawdown of 34%, resulting in a CAR/MDD of 011 The worst performing moving average was the least squares The 0day moving average support is 2,637 or 11% below its current value If it falls this far it would be a drop of 22% from its alltime high Weekly chart with 0day moving average highlighted

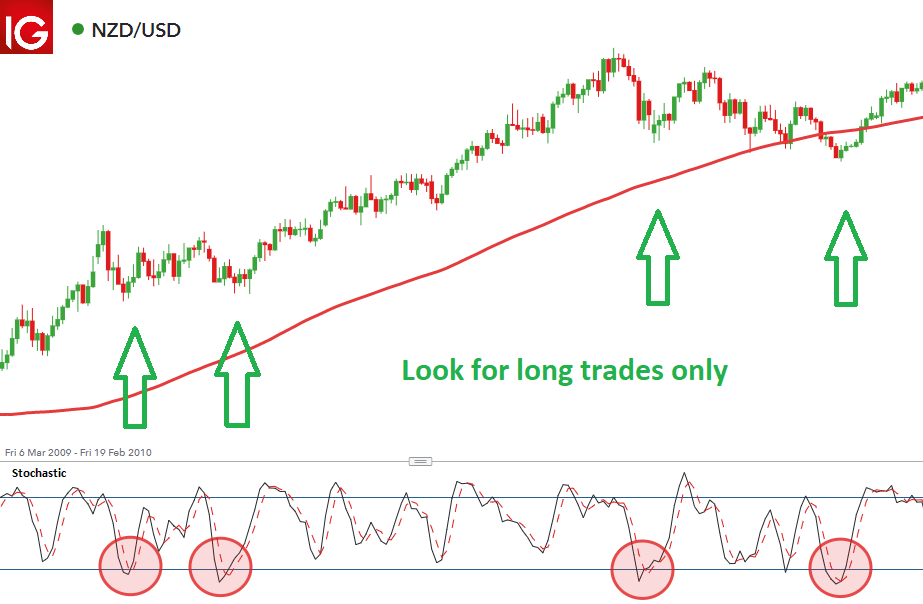

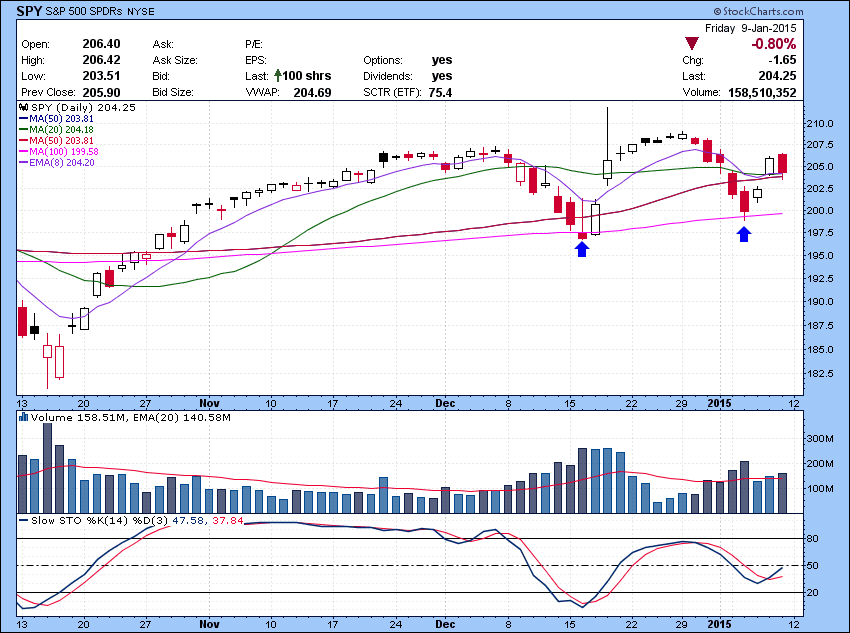

Here's how it works Let's assume over the last 5 days, Apple shares closed at 100, 90, 95, 105, and 100 So, the 5period MA is 100 90 95 105 100 / 5 = 98 And when you "string" together these 5period MA values together, you get a smooth line on your chart Now the concept is the same for the 0 day moving averageFor example, if the price is above the moving average of the security then this is generally considered an upward trend or a buy Note A security needs to have more than 0 active trading days in order to generate an Opinion reading; The SPY is trading below the eightday and 21day exponential moving averages (EMA) but the eightday EMA is trending above the 21day, which indicates indecision The SPY is trading well above

The 100 day moving average takes the closing prices of the day for the last 100 days Those numbers are added up and divided by 100 That is done every day That number gives the price of the moving average for the day That is how moving averages are created SPY is heating 0 point today and closed above the 0 point Other major consideration is spy is also heating 100 day simple moving average after a 5 month period and closed above the 100 day simple average 0 point is very important because last spy was broke down as it went down to 0 point and came all the way down to 181 A longer moving average (such as a 0day MA) can serve as a valuable smoothing device when you are trying to assess longterm trends Others could care less Here's Josh Brown, advisor at Ritholtz Wealth Management Talk of the S&P 500 bumping up against its 0day moving average creates the impression that this overlay represents some

0 Day Moving Average Vs Buy And Hold New Trader U

Ideas And Forecasts On Percent Of Stocks Above 50 Day Average Index Mmfi Tradingview

0day Moving Average is a longterm trendfollowing technical indicator It uses last 0 days or 40 weeks data to analyze the movement of stock prices 0day Moving Average is widely used to analyze major market trends 3,973 = 100 day moving average 3,732 = 0 day moving average So yes, I still believe that the 100 day moving average will be tested before all is said and done However, there is not much need to test the 0 day moving average at 3,732SPY latest price $ (042%) ($ $) on Wed Trend Analysis and Forecast Trend Narrative Breakdown Price Pattern Downtrend Pop Average Daily Price Swing $0 (155% one month average) Average Daily Percentage Swing 074% (three month average) Moving Force (Hourly Trend Force) 60% Trend Force 0% RSI

Trade Of The Day Shorting The Spy Etf

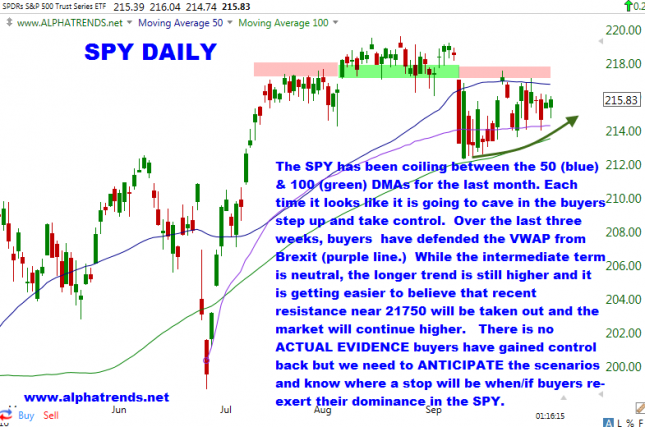

Spy Coiling Between 50 100 Day Moving Averages Alphatrends

A less clearcut but effective way is to use the 10day moving average This is a shortterm price indicator that tracks the closing prices over the past 10 sessions ( All daily charts in When the SPY is trending above the 8 & 21 day moving averages, I am in a Portfolio Approach I'll usually have 412 long positions in stocks showing relative strength, and occasionally even more When the SPY breaks the 8 & 21 day moving averages, I0day Moving Average and 50day Moving Average A 0day moving average generally indicates a longterm trading and it moves slower and smoother A 50day moving average commonly represents an intermediate trading and it moves faster and is more sensitive to price changes Customize settings and timeframe of your favorite indicator

Algorithmic Trading In Python Simple Moving Averages By Aidan Wilson Towards Data Science

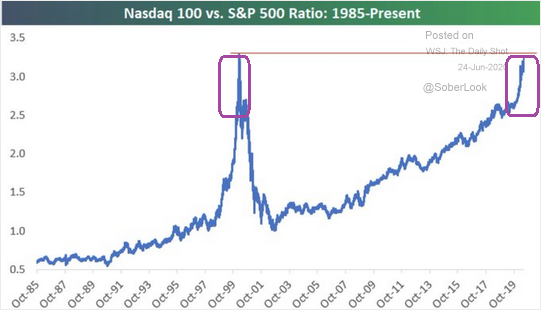

Has The Technology Sector Run Too Far Too Fast

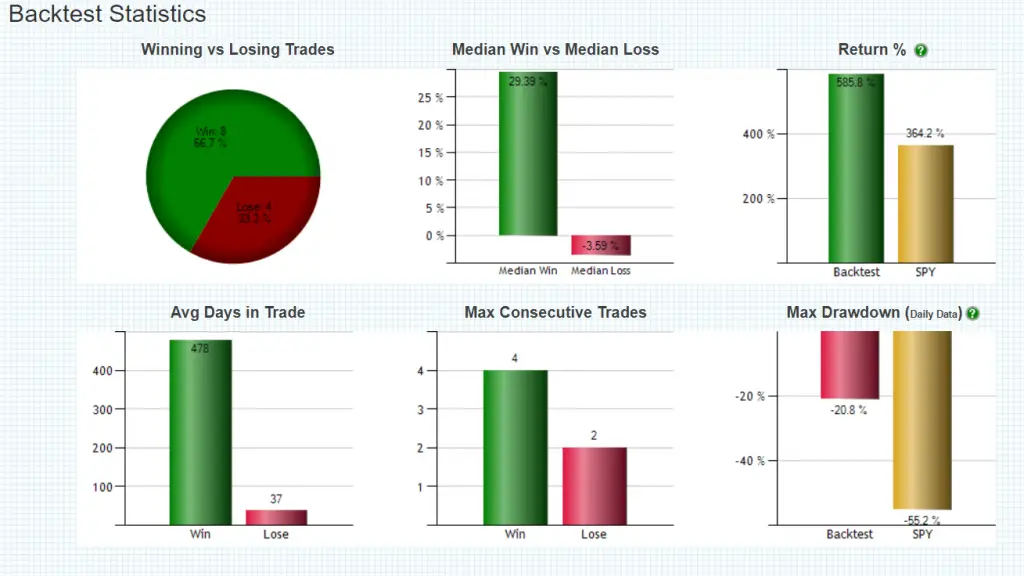

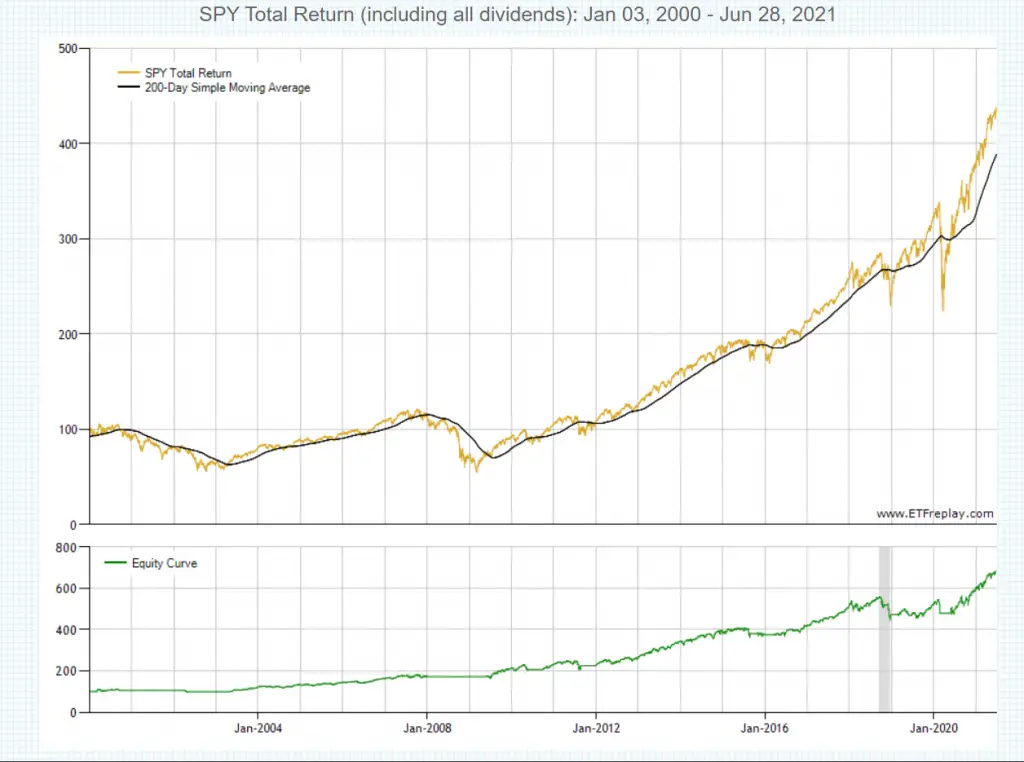

The screen above represents a backtest of SPY, entering when the Price rises above the 0day Simple Moving Average and exiting when Price drops below the SMA Options include the type of moving average to use (SMA or EMA), the length of the moving average, and what symbols to enter/exit when signals are generatedMoving averages for SPDR S&P 500 Trust ETF (SPY) 10 day simple moving average compared with 50 day, 100 day, 0 day See the moving averages on the chartThanks so much for all the support, Anyone who has any questions please leave in comments i would love to be a part or your success If you have any sugge

Detrended Price Oscillator Dpo Chartschool

Improvements To A Volatility Indicator Justin Czyszczewski

Moving Average Strategy #5 Using Moving Average for Taking Profits Most moving average strategies are focused on following trends and it is fundamentally different from setting a predefined arbitrary profit target like 100 pips or 0 pips based on your reward toThe 0day simple moving average refers to 0 periods on the daily chart This takes 0 trading days into consideration – which is a ton of trading days Remember, there is only about 252 2 trading days in a year, so the SMA 0 is a big deal This is how a 0day moving average looks on the chart 0Day Simple Moving AverageFor futures, the contract must have more than 100 active trading days

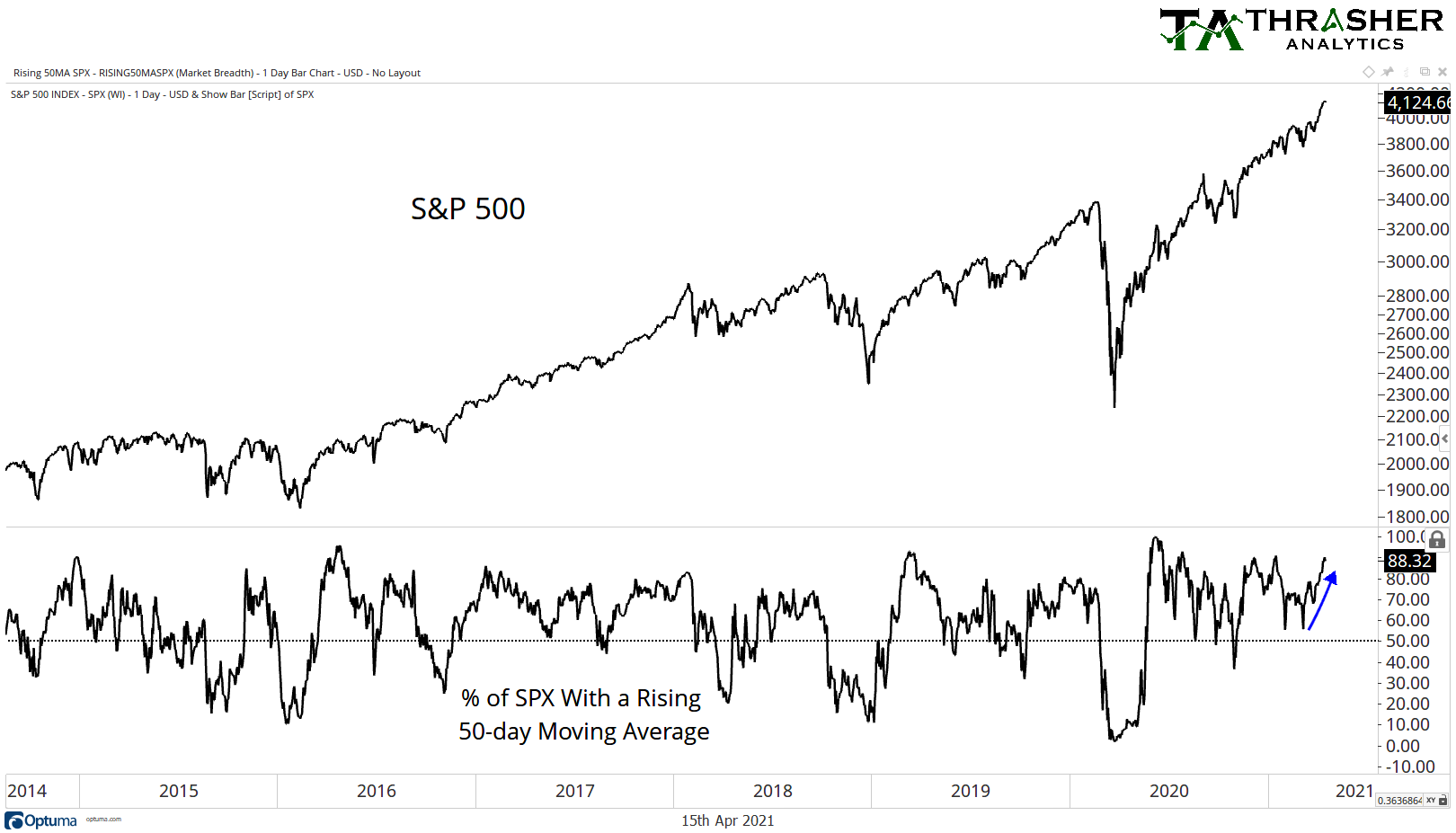

Andrew Thrasher Cmt Of S Amp P 500 Stocks Have A Rising 50 Day Moving Average Spx Spy T Co Djtuz4nfld Twitter

Algorithmic Trading In Python Simple Moving Averages By Aidan Wilson Towards Data Science

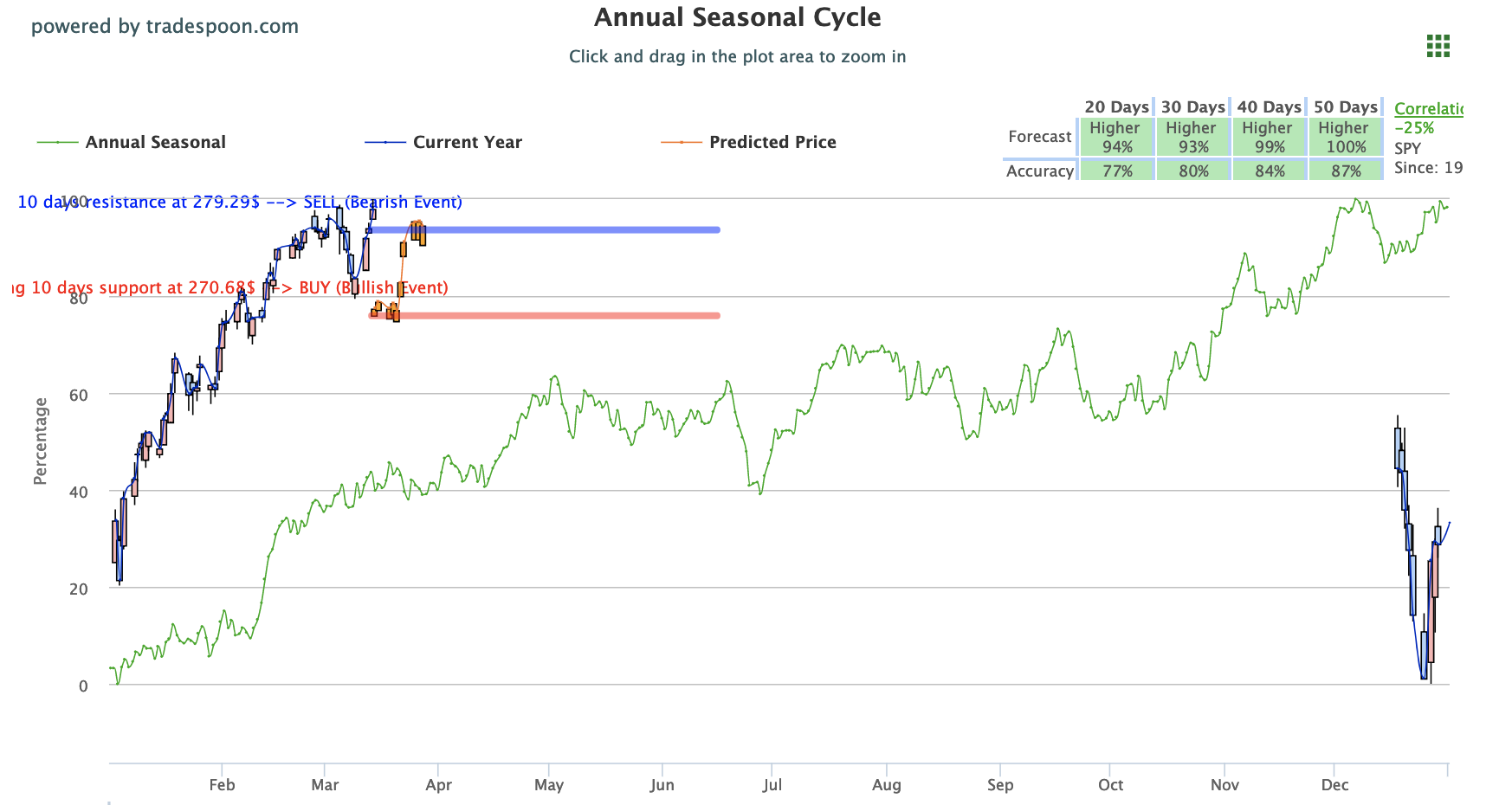

Moving averages trading is a concept of trying to time the trend of the underlying security to pick movements up and down in the security to profit by that trend When using option strategies for income, applying moving averages trading can be especially profitableThis article examines using the 10 day simple moving average in combination with the and 30 day exponential moving averages The chart below shows the one year price performance of SPY, versus its 0 day moving average Looking at the chart above, SPY's low point in its 52 week range is $ per share, with $Impressive 30% rally off March 23 lows, capped by last week's bear trap and Monday's bounce to new cycle highs Most of the fundamental news behind the rally long priced into stocks So what to expect now?

Quality Is The Lone Equity Factor Beating The Market This Year The Capital Spectator

The Four Most Commonly Used Indicators In Trend Trading Trading Articles Trade2win

SPY reaches 0day Moving Average What next? On the upside, let's see if SPY can rally to its 100day moving average Above that puts $3 on the table On the downside, though, it has the prior breakout level near $300, the 0day moving The 9 and exponential moving average crossover strategy is a great tool You can add these EMAs to your 1 and 5 minute charts for day trading This strategy is excellent in helping you determine the direction of a stock and when to get in and out When it's used on the 2 time frames of the 1 and 5 minute charts it's awesome

0 Day Moving Average What It Is And How It Works

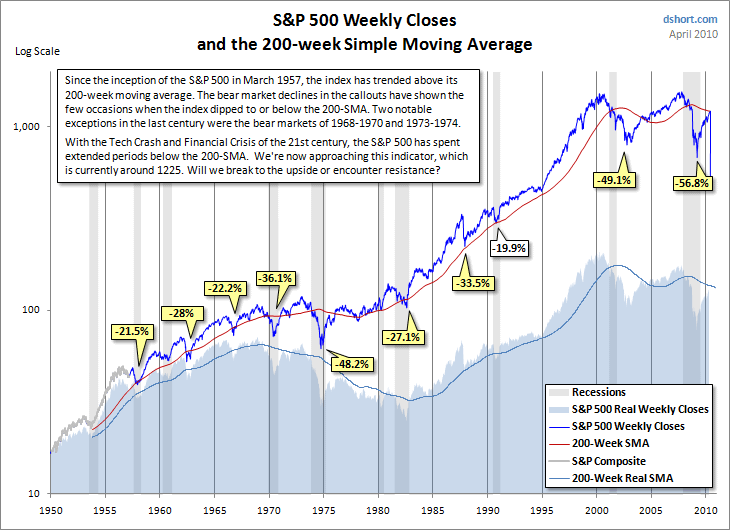

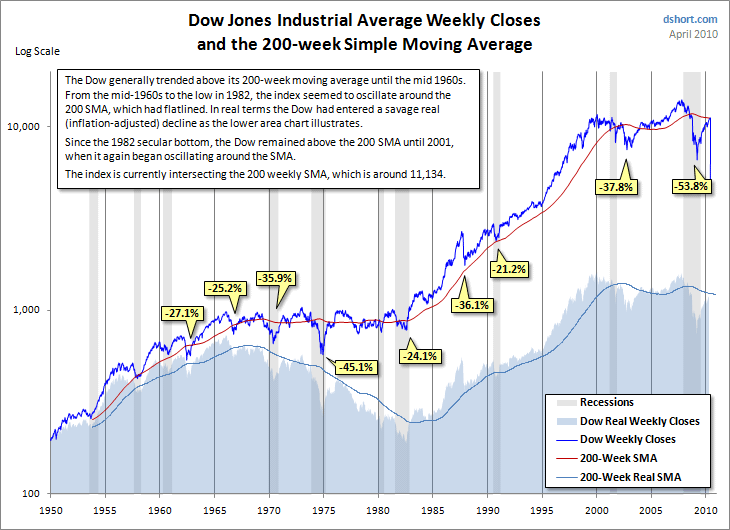

The 0 Week Moving Average In Market History Seeking Alpha

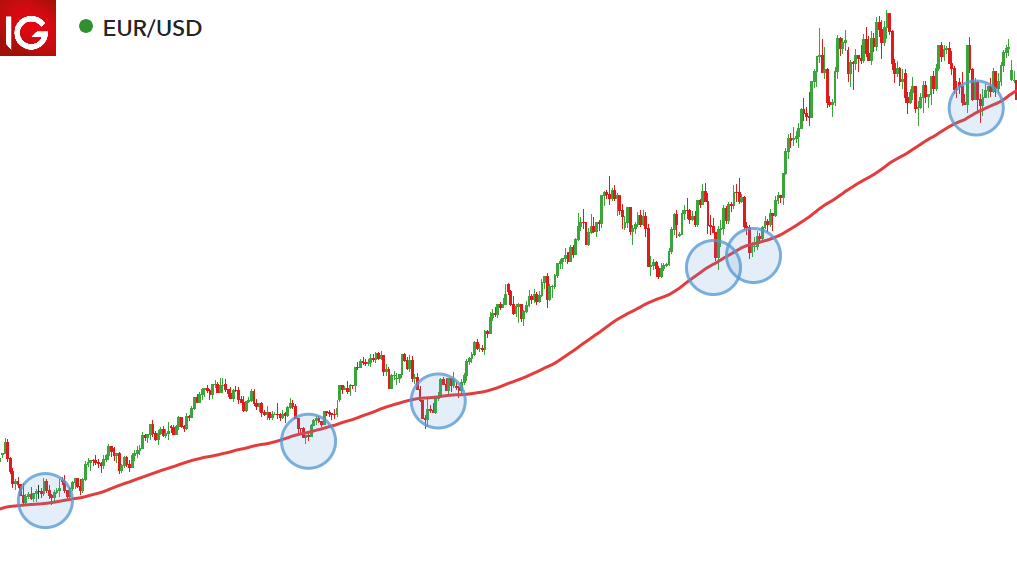

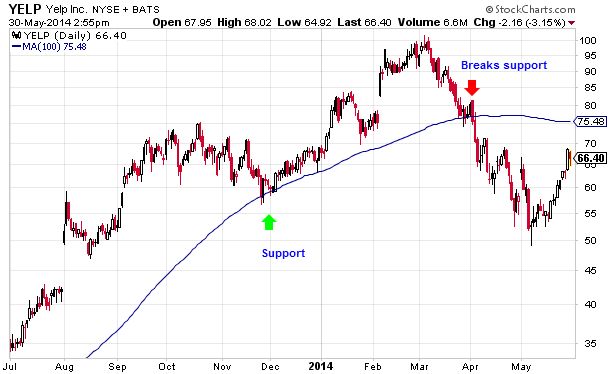

In an uptrend, a 50day, 100day or 0day moving average may act as a support level, as shown in the figure below This is because the average acts like6 rows Moving Average Price Change Percent Change Average Volume The Moving Average is the The 50day simple moving average (SMA) is used by traders as an effective trend indicator Along with the 100 and 0day moving averages, the 50day average is

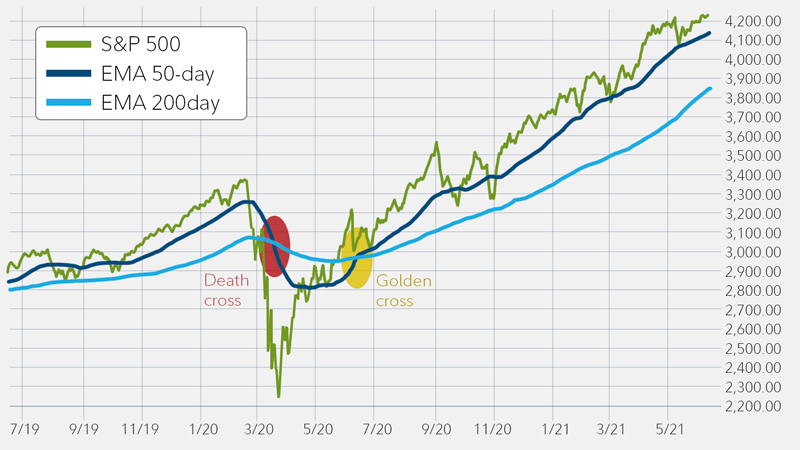

/GoldenCross-5c6592b646e0fb0001a91e29.png)

Golden Cross Definition

Stock Signals Us Stocks Indicator Average Fidelity

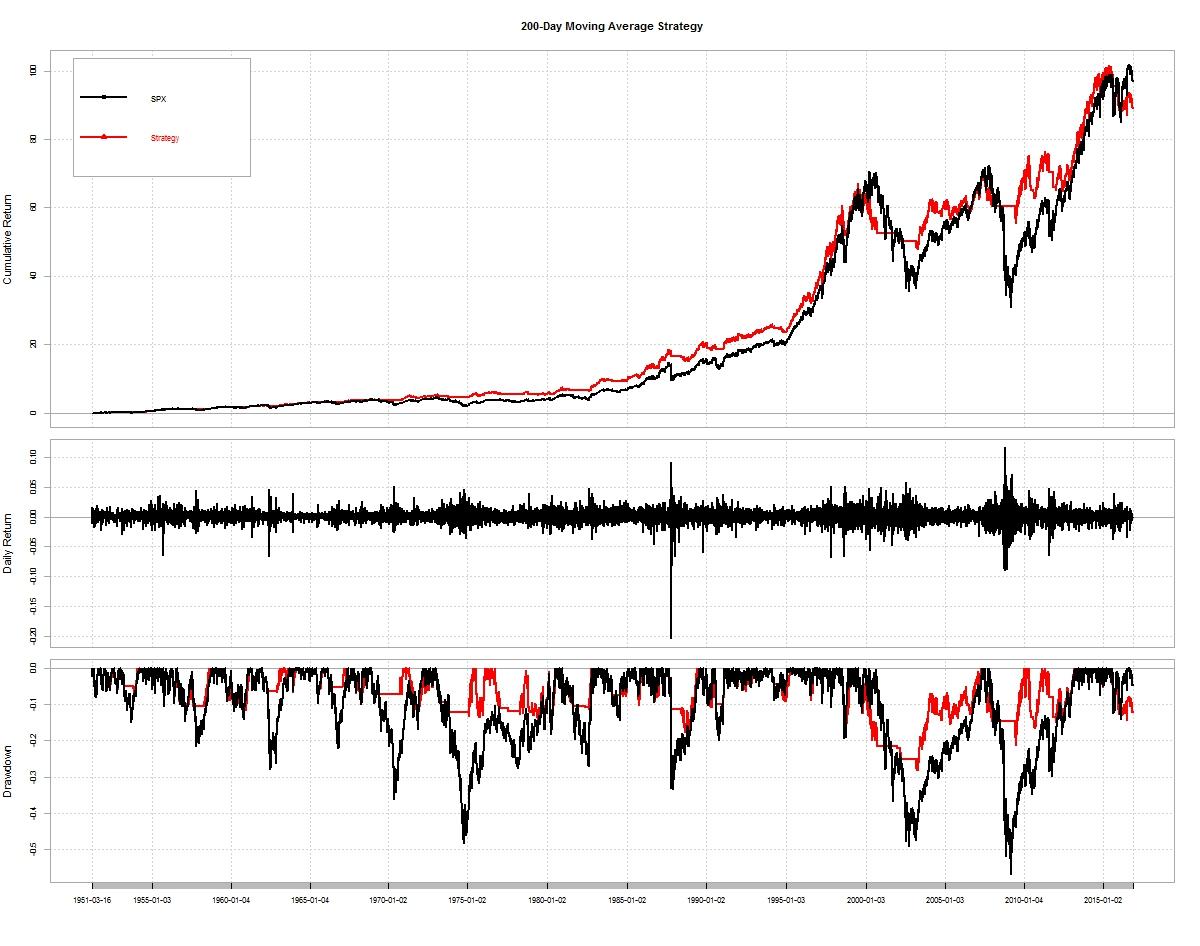

Among the moving averages, the 0day is probably the most used and referred to This article looks at the 0day moving average and how it works, why it works, and additionally why it sometimes doesn't work As with most things in life, the 0day moving average comes with both pros and consSince 1951, the 0day moving average strategy has returned 711% at a standard deviation of 101%, resulting in a Sharpe ratio of 0704 That compares with theIn particular, SPY settled nearly flat with its 160day moving average on Monday, June 3 the low close of its current 160day outing, at which point its return for the streak had nearly

Best Strategies To Use With The 0 Day Simple Moving Average

Buy And Hold Vs Moving Average Crossover And A Gentle Intro To Quantopian By Graham Guthrie Wealthy Bytes Medium

0day moving average () 50day moving average () Source Haver Analytics yardenicom Figure 6 S&P 500 Moving Averages Page 3 / / 0Day Moving Averages wwwyardenicom Yardeni Research, IncInteractive Chart for SPDR S&P 500 (SPY), analyze all the data with a huge range of indicatorsLet's take a simple backtest of how buying SPY when the 2period RSI was below on the daily chart Entry Criteria 2day RSI of SPY < ;

Spy Large Inflows Detected At Etf Nasdaq

What A Difference A Day Makes Or Fooled By Look Ahead Bias Investment Solutions Portfolio Construction Experts Portfoliowizards

The S&P 500's moving average The S&P 500 index (SPY) was trading at 27 at the end of the ay on March 16, recovering from its earlier low of 1810 onExit Criteria 2day RSI of SPY > 65; The 50day moving average has acted as support for stocks several times this year, including in January, March, and May A break below this support level would be a bearish shortterm signal, as would a break below the 0day moving average A break below the longerterm moving average would be considered the "stronger" signal

Stocks Still Face Numerous Hurdles Spy Tza Tna Sds Sso Etf Daily News

The Real Importance Of The 50 100 And 0 Period Moving Averages In Profitable Fx Trading Fx Trading Revolution Your Free Independent Forex Source

So far the 100day moving average has been holding the SPY pretty well and Tuesday again validated this The 100day support sits at $433 today We expect to see a bounce today with a retracementCurrent price of SPY > 100day simple moving average; We can also see how quite nicely the SPY bounced off the 100day moving average at $433 We will take this as our key level for Thursday, below look for further losses but opening above can lead

Charting A Fragile Market Recovery Attempt S P 500 Reclaims 0 Day Average Marketwatch

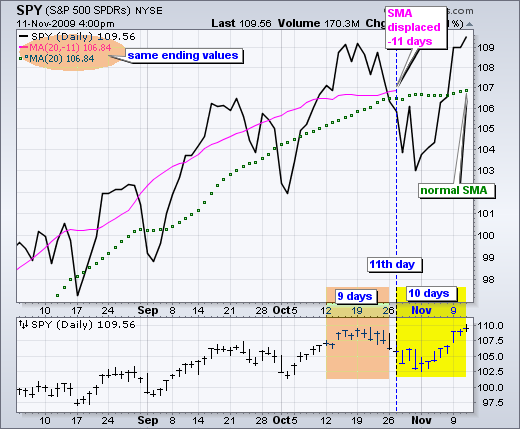

The Spy 10 100 Sma Long Only System

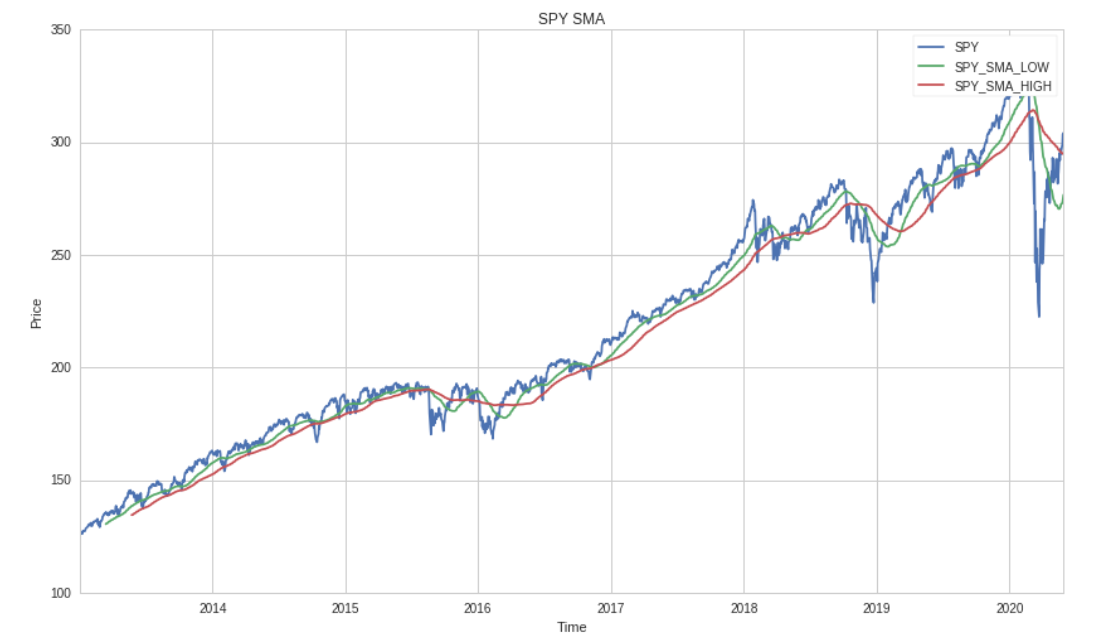

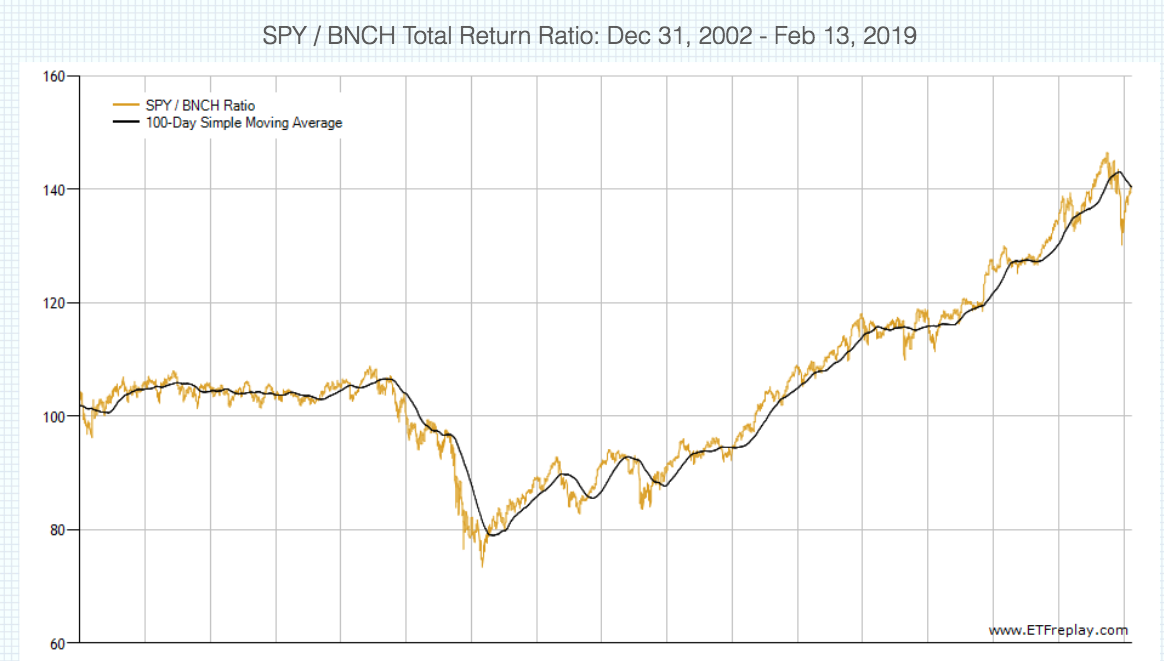

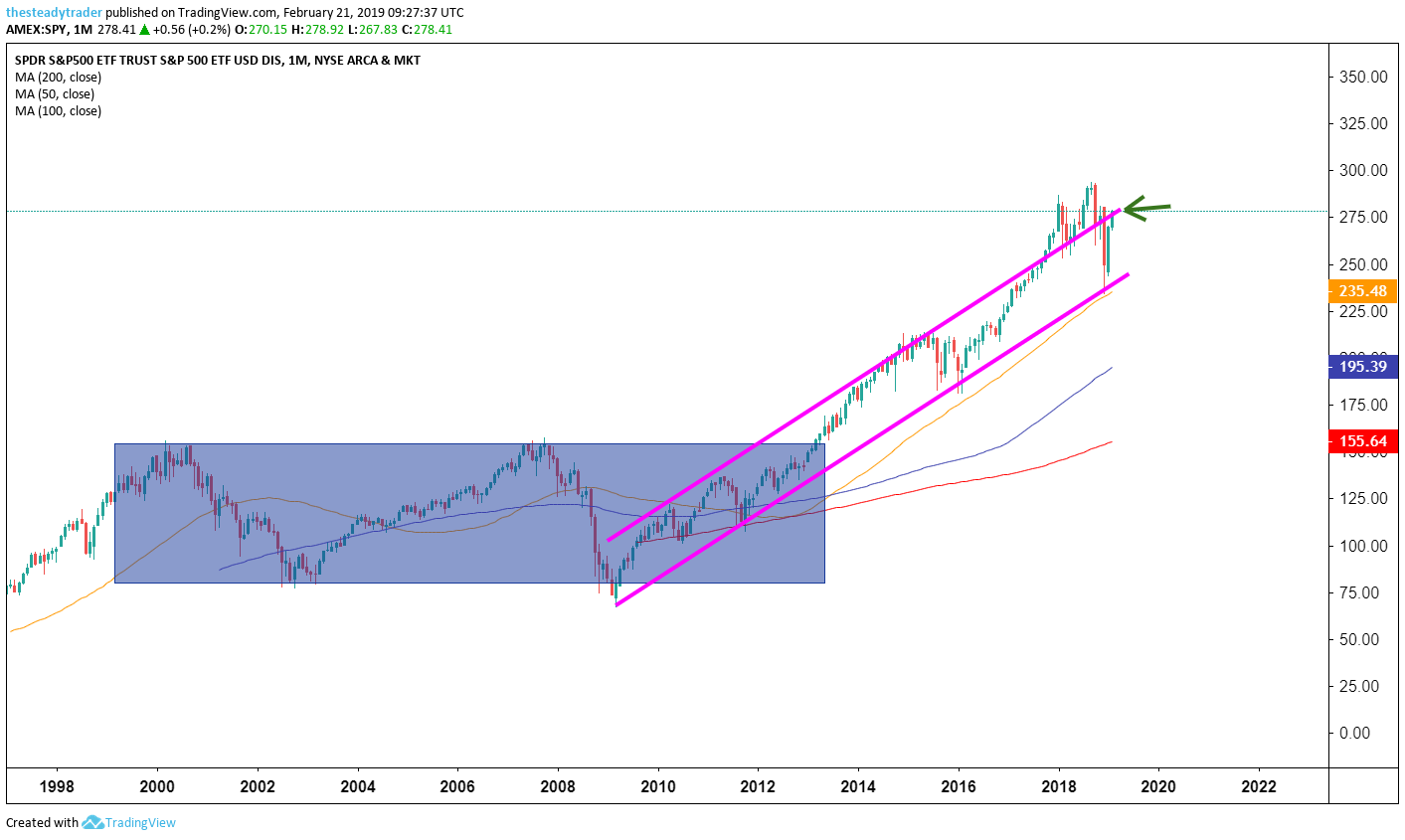

The chart below is a weekly chart for the S&P 500 ETF (SPY) with two simple moving averages that approximate the 50 day (10 weeks) and 0 day (40 weeks or 10 months) moving averagesThe strategy I tested had just two triggers (i) go long the S&P 500 SPDR ETF (SPY) whenever the index closes above the 0day moving average and (ii)

0 Day Moving Average Magic The Chartist

Average Daily Percent Move Of The Stock Market

0 Day Moving Average What It Is And How It Works

Market Moving Event Alerts Strategies Weak Global Data Brexit Snaps Three Day Streak Market Moving Event Alerts Strategies

Evergrande Crisis Triggers This Short Term Stock Market Sell Signal

Lighten Up On The Nasdaq 100 Qqq Thestockbubble Com

Make The Trend Your Friend With This Spy Trade Market Recon Realmoney

More Uncommon S P Moving Averages To Watch

/dotdash_INV-final-Death-Cross-Definition-June-2021-01-7a934ae7f94f4678acc75f8c63475131.jpg)

Death Cross Definition

Charting A Corrective Bounce S P 500 Reclaims 0 Day Average Marketwatch

3 Ways To Use Moving Averages In Your Trading

10 Day Moving Average How To Trade With The Indicator

Exponential Moving Average Ema Overview How To Calculate

100 Day Moving Average Definition Calculation Strategies

Weekly Wrap The New Safety Not So Safe Nysearca Spy Seeking Alpha

Spy Hits Resistance Chartwatchers Stockcharts Com

Using Pmi Data For Tactical Asset Allocation Backtestwizard

Buy And Hold Vs Moving Average Crossover And A Gentle Intro To Quantopian By Graham Guthrie Wealthy Bytes Medium

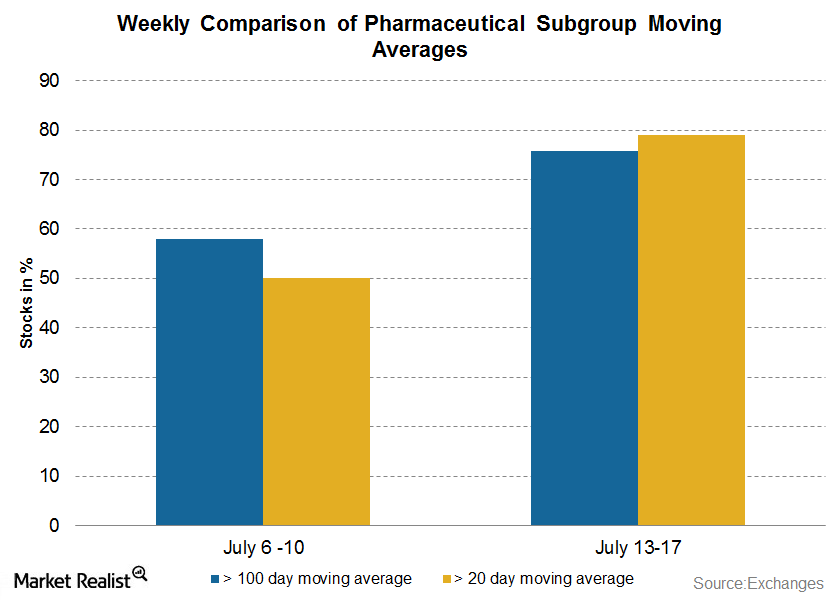

Pharma Stocks Show A Positive Trend

How To Beat The Market In The Long Run With Trend Following Strategies Nysearca Spy Seeking Alpha

Spy

Market Talk 3

Charting A Fragile Market Recovery Attempt S P 500 Reclaims 0 Day Average Marketwatch

Stocks Drop Sharply On September As The 50 Day Moving Average Is Shattered Traders Insight

System Trading With Woodshedder Page 58 Just Another Weblog

Dailyfx Team Live The S P 500 Finds Temporary Support In The 100 Day Moving Average With The Index Down Over 2 2 On The Day Spx Spy Es T Co Ejryerols5

Here S The Surprising Etf That S Beating The Market 2 To 1 True Market Insiders

An Algorithm To Find The Best Moving Average For Stock Trading By Gianluca Malato Towards Data Science

Stochastics Sell Signal And 50 Day Moving Average Rejection Spy Sds Sso Sh Spxu Etf Daily News

Charting An Ominous Technical Tilt S P 500 Plunges From The 0 Day Average Marketwatch

/dotdash_Final_Strategies_Applications_Behind_The_50_Day_EMA_INTC_AAPL_Jul_2020-01-0c5fd4e9cb8b49ec9f48cb37d116adfd.jpg)

Strategies Applications Behind The 50 Day Ema Intc pl

Spdr S P 500 Etf Trust Spy Stock News And Forecast Time To Squeeze

Spy Stock Leverage Took Advantage Of Buy On Dip Strategy Investor S Business Daily

S P Index Below Its 100 Day Moving Average

100 Day Moving Average Definition Calculation Strategies

Why The Spy 160 Day Moving Average Matters

960e7hg3p Etlm

Study Spy Etf Returns Above Below 0 Day Simple Moving Average See It Market

Mechanical Trading Of Channelling Swing System Ppt Download

Spdr S P 500 Etf Trust Spy Stock News And Forecast Why Is The Spy Falling And What Next

Short Sellers Be Prepared For A Countertrend

The Real Importance Of The 50 100 And 0 Period Moving Averages In Profitable Fx Trading Fx Trading Revolution Your Free Independent Forex Source

Spy 100 Day Moving Average Charts S P 500 Spdr

Watch List 01 12 15 Bulls On Wall Street

6x42wguu2zacym

Tech Stocks Leading Us Sectors By Wide Margin In 19 The Capital Spectator

-637685902834276513.png)

Spdr S P 500 Etf Trust Spy Stock News And Forecast This Dead Cat Can Bounce Time To Buy The Spy

Decided To Try Timing The Market 100 Short On 9 17 15 Page 5 Bogleheads Org

Vxx Volatilityanalytics Com

1

Using Pmi Data For Tactical Asset Allocation Backtestwizard

Moving Averages 40 60 And 0 Contracts For Difference Com

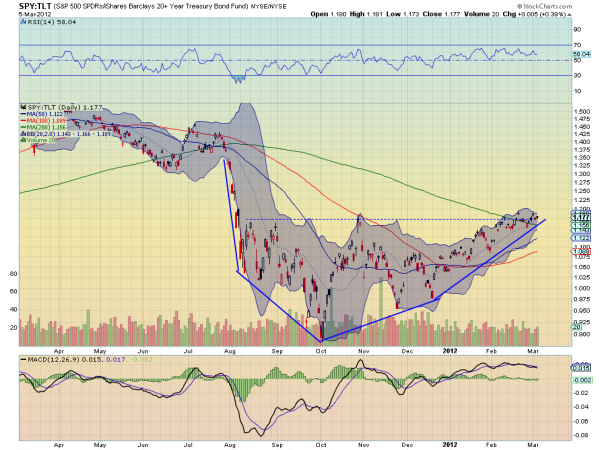

A Love Triangle Bonds Equities And The Dollar

What S A Good Buy Right Now For This Coronavirus Market Redflagdeals Com Forums

Trade Of The Day Shorting The Spy Etf

Us Large Cap Volatility Reduction With Us Gov Bonds Rotationinvest Com

Market Moving Event Alerts Strategies Global Markets Up On First Day Of New Quarter China U S Trade Talks Continue In D C This Week Market Moving Event Alerts Strategies

The 0 Week Moving Average In Market History Seeking Alpha

0 Day Moving Average Vs Buy And Hold New Trader U

3 Ways To Use Moving Averages In Your Trading

S P 500 Moving Average Strategies Since 1951 Evidence From Backtesting Nysearca Spy Seeking Alpha

Will The Tactical Guys Blow Up The Market On Monday The Reformed Broker

Theslayer S Market Thoughts 13 08 25

Fwp 1 Formfwp Htm Global Tactical Equity Total Return Index The

The Ftse100 Chart Gives A Death Cross Signal While Us Market Futures Remain Undecided Spy Dia Ftse100 Dax Value The Markets

Mhwxrpinmq8r M

How To Use Moving Averages To Improve Your Trading Trendspider Blog

Spy Monthly Chart Suggests This Decline Is Just Getting Started 16th Day Of Qqq Short Term Down Trend Wishing Wealth Blog

Spy Am I Wrong About A Stock Market Correction

What Is A Bullish Cross

The Best Back Tested Trading Strategies With Moving Averages New Trader U

Oldkgwova6l6im

1

50 Percent Above Moving Average Index Spy Study For Index Mmfi By Beckyhiu Tradingview

100 Day Moving Average Definition Calculation Strategies

Algorithmic Trading In Python Simple Moving Averages By Aidan Wilson Towards Data Science

Moving Averages Trading Using The 10 30 Rule Fullyinformed Com

Analysis Of S P 500 Returns Above Below The 0 Day Sma Spy Spx Theta Trend

Stocktwits The S P 500 Spy Is Sitting At Its 100 Day Moving Average Right Now This Chart And Here S How The Market Has Been Performing 1 Month 5 5 Ytd 0 25 6 Months

0 件のコメント:

コメントを投稿